info-shaman.ru Overview

Overview

Does Rent A Center Move Your Furniture When You Move

If you leave things behind when you move, your landlord can sell them, keep them, or throw them away. This includes furniture, cars, appliances, clothing. Will Aaron's move my merchandise? Yes! While you are leasing from Aaron's we will move your merchandise for you provided you are moving within 15 miles of your. No, you would be better off trying to find some furniture pieces off Facebook marketplace or at yard sales. You'll be making monthly payments on stuff that you. I am requesting a full refund of cancellation of this purchase agreement. No furniture was ever received from RAC and will not be excepted under their false. The Home Depot offers moving and lifting equipment rentals for you next move including moving trailers, lifts, hand dollies, and more. First time? We've got you. Our Truck Renter's Guide will make sure you have everything you need to keep things moving smoothly with your rental. Listen, we had just moved here, we didn't have a truck or resources to go free cycling or drive around looking for one. We needed furniture now. Rent-A-Center (RAC) is a Texas-based furniture and electronics rent-to-own company that offers new and used brand-name furniture, appliances, computers, and. With furniture rentals from your local Gary Rent-A-Center, that's not a problem! Our Worry-Free Guarantee means you can swap your furniture out when you need a. If you leave things behind when you move, your landlord can sell them, keep them, or throw them away. This includes furniture, cars, appliances, clothing. Will Aaron's move my merchandise? Yes! While you are leasing from Aaron's we will move your merchandise for you provided you are moving within 15 miles of your. No, you would be better off trying to find some furniture pieces off Facebook marketplace or at yard sales. You'll be making monthly payments on stuff that you. I am requesting a full refund of cancellation of this purchase agreement. No furniture was ever received from RAC and will not be excepted under their false. The Home Depot offers moving and lifting equipment rentals for you next move including moving trailers, lifts, hand dollies, and more. First time? We've got you. Our Truck Renter's Guide will make sure you have everything you need to keep things moving smoothly with your rental. Listen, we had just moved here, we didn't have a truck or resources to go free cycling or drive around looking for one. We needed furniture now. Rent-A-Center (RAC) is a Texas-based furniture and electronics rent-to-own company that offers new and used brand-name furniture, appliances, computers, and. With furniture rentals from your local Gary Rent-A-Center, that's not a problem! Our Worry-Free Guarantee means you can swap your furniture out when you need a.

Make your home move-in ready with a few simple clicks. Select your style and we will do the rest. Our expert designers will select matching furniture and. Hello, USA! We noticed you are shopping on our site from outside of Canada. Please visit our U.S. website to shop for product and offers available in your. Additionally, renting furniture is a great way to save money and time. Companies like Cort and Rent-A-Center are two great options. Remember, this is your first. The lease is your contract with the landlord. Leases can freeze your rent for a definite term or can be for an indefinite term, such as week-to-week or month-to. When you shop at Rent-A-Center, setup and delivery come with your purchase. You'll never have to worry about how you're going to move your new bed all the way. Need help moving just one piece of furniture? Moving Help® offers moving labor solutions for any size move, at a reasonable price. the amount of rent that can be collected. If you plan to move and have a written lease agreement, you must give notice according to the provisions of your lease. The Home Depot offers moving and lifting equipment rentals for you next move including moving trailers, lifts, hand dollies, and more. Most stores accept cash, debit or credit card for payment. Can I buy the merchandise after renting it for a while? Our Early Buyout option allows you to. Get your moving truck from Penske Truck Rental. We have great rates on truck rentals at over rental locations to serve all of your moving truck needs. When you shop at Rent-A-Center, professional delivery and setup are part of the deal. You'll never have to worry about how you're going to move your new bed. Additionally, renting furniture is a great way to save money and time. Companies like Cort and Rent-A-Center are two great options. Remember, this is your first. And as your Attorney General – I will do all that I can to make Louisiana an even better place to live, work, and raise a family. Sincerely,. Jeff Landry. I am requesting a full refund of cancellation of this purchase agreement. No furniture was ever received from RAC and will not be excepted under their false. No Problem! Simplify your move with hassle-free furniture rental - leave the heavy lifting to us! Need help moving just one piece of furniture? Moving Help® offers moving labor solutions for any size move, at a reasonable price. If the lease does not say anything about property left behind, then the landlord must move or store the tenant's belongings, even if they think they are trash. With Rent-A-Center, professional delivery and setup are included. You don't need to worry about how you're going to move your new bed up the stairs to your. Now that you've embarked on your rent to own journey, you should know that you have options to choose from. Besides Aaron's, Rent-A-Center is another option in. Prepare for a new apartment with all the furniture, appliances and decorations you need. Learn more about essential first apartment items here!

How To Get Wifi In Your House Without Cable

The modem is responsible for receiving your internet connection and communicating with the internet. Then, a router broadcasts a wireless signal to your. Wi-Fi extenders help you get full Wi-Fi coverage throughout your home. They eliminate areas that hardly get any Wi-Fi signal. They can also help you get. Wifi, by definition, is wireless, and doesn't need a cable. You can use it by turning on an access point configured to broadcast an SSID. Both types of high-speed internet will get you online, but they serve different purposes. Wireless home internet is a new type of internet connection that. Set up your router to maximize performance and optimize security. · Connect your wireless devices to save you time and hassle. · Recommend solutions for dead. All you need to do is plug one adapter into the power socket of your router as well as connect an ethernet cable. Then, you plug the second adapter into an. 7 ways to get internet without cable · 1. Fiber-optic internet · 2. Cable internet · 3. DSL. Physically moving the router can make a real difference to the speeds you get and how far its wireless transmissions can reach. The perfect spot will depend on. There are many options for getting internet without a cable or phone plan. We'll talk about all of the best options, from 5G and DSL to fiber and satellite. The modem is responsible for receiving your internet connection and communicating with the internet. Then, a router broadcasts a wireless signal to your. Wi-Fi extenders help you get full Wi-Fi coverage throughout your home. They eliminate areas that hardly get any Wi-Fi signal. They can also help you get. Wifi, by definition, is wireless, and doesn't need a cable. You can use it by turning on an access point configured to broadcast an SSID. Both types of high-speed internet will get you online, but they serve different purposes. Wireless home internet is a new type of internet connection that. Set up your router to maximize performance and optimize security. · Connect your wireless devices to save you time and hassle. · Recommend solutions for dead. All you need to do is plug one adapter into the power socket of your router as well as connect an ethernet cable. Then, you plug the second adapter into an. 7 ways to get internet without cable · 1. Fiber-optic internet · 2. Cable internet · 3. DSL. Physically moving the router can make a real difference to the speeds you get and how far its wireless transmissions can reach. The perfect spot will depend on. There are many options for getting internet without a cable or phone plan. We'll talk about all of the best options, from 5G and DSL to fiber and satellite.

1 Use a public Wi-Fi network. · 2 Tether to a device that has internet service. · 3 Use your mobile provider's hotspot. · 4 Share the internet with a friend or. Xfinity Internet Essentials: Most available service · Spectrum Internet Assist: Good unlimited plan · Access from AT&T: Affordable options · Assurance Wireless. First, you need a wireless router and some type of wifi adapter for your computer. These can be either built-in, PCI, or USB. When a device is connected with an Ethernet cable it can achieve its fastest speeds. Wireless speeds for our internet are available using the WiFi signal from. Can you connect to internet without cable? Yes, and fiber-optic internet is your best bet Fiber internet is faster and more reliable than cable or DSL. Your router is the brains of your home network, responsible for distributing the internet to your devices, either wirelessly or via Ethernet cables. Knowing. Without outstanding debt for Charter/Spectrum service within the last year; Cannot have had a Charter/Time Warner Cable/Bright House Network broadband. If you already have high-speed (broadband) Internet service at your house, it's pretty easy to create your own home wireless network. Commonly known as Wi-Fi, a. Though not feasible for all homes or people, consider using an Ethernet cable to connect directly to your WiFi router if possible. A wired connection to your. It usually involves a wireless router that sends a signal through the air. You use that signal to connect to the internet. But unless your network is password. 2. USB Tethering USB tethering allows you to connect your laptop to your phone using a USB cable and share your phone's internet connection. Most internet providers loan or rent a wifi router to you when you sign up and get your internet service. If not you will need to buy your own wifi capable. Wireless router. A router sends info between your network and the Internet. With a wireless router, you can connect PCs to your network using radio signals. Portable routers, also known as travel routers, are not too different from the router you have at home. Instead of being connected to the internet via a cable. Probably the best way to extend the range of your home Wi-Fi signal is to get a Wi-Fi extender or a mesh router system that transmits the signal to the whole. Home Wi-Fi through an internet provider available to you provides your household with the internet connection you need to wirelessly connect all of your devices. Fixed wireless is an internet connection that uses radio waves to transmit high-speed data between two fixed points. It is similar to satellite internet, but. 1. Select the right internet service provider · 2. Notify your chosen internet provider about your start date · 4. Set up your wireless network · 5. Connect your. 1. Mobile Hotspot · 2. Tether Your Smartphone or Tablet · 3. Find a Public Wi-Fi Network · 4. Use a Wi-Fi USB Dongle · 5. Share a Friend's Internet Connection. No. Self-installation for Spectrum in-home WiFi is easy. Simply connect your modem to your incoming cable outlet. Then, connect your modem to your Spectrum WiFi.

How Much Should I Spend Monthly On A Car

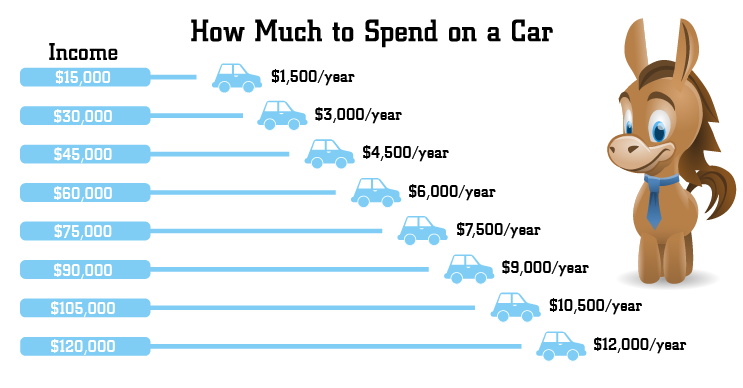

If you have an average credit score, a auto loan with a four-year loan term and $1, down could cost you over $1, a month. Despite the ongoing rise in car. Is a Month Car Loan a Good Idea? Car loans often have variable interest rates, so in a rising rate environment, a shorter loan could be a better idea. While. The common rule of thumb among financial experts is that you should spend less than 10% of your income on your car payment and not more than 15% to 20% of your. Experts suggest that you shouldn't spend more than 20% of your take-home pay towards monthly auto payments and related expenses. The exact amount you pay toward. vehicles that are sold privately or through dealerships. Try our vehicle loan calculator to see how much your monthly payments could be. Vehicle loan amount. One source says the average monthly cost of car ownership for a vehicle that's driven 15, miles a year is $ a month. If this sounds like your situation. I follow15% rule. Your car emi should not be more than 15% of your total monthly income. With this rule, you should not pay more than rs. Finding the right budget for car finance · Don't spend more than 10% of your take-home pay on a car finance payment · The total expenses of your car shouldn't be. If you are unsure how much you should spend on a car, we recommend using the 20/4/10 rule. 20/4/10 is a simple rule of thumb that helps you find a vehicle that. If you have an average credit score, a auto loan with a four-year loan term and $1, down could cost you over $1, a month. Despite the ongoing rise in car. Is a Month Car Loan a Good Idea? Car loans often have variable interest rates, so in a rising rate environment, a shorter loan could be a better idea. While. The common rule of thumb among financial experts is that you should spend less than 10% of your income on your car payment and not more than 15% to 20% of your. Experts suggest that you shouldn't spend more than 20% of your take-home pay towards monthly auto payments and related expenses. The exact amount you pay toward. vehicles that are sold privately or through dealerships. Try our vehicle loan calculator to see how much your monthly payments could be. Vehicle loan amount. One source says the average monthly cost of car ownership for a vehicle that's driven 15, miles a year is $ a month. If this sounds like your situation. I follow15% rule. Your car emi should not be more than 15% of your total monthly income. With this rule, you should not pay more than rs. Finding the right budget for car finance · Don't spend more than 10% of your take-home pay on a car finance payment · The total expenses of your car shouldn't be. If you are unsure how much you should spend on a car, we recommend using the 20/4/10 rule. 20/4/10 is a simple rule of thumb that helps you find a vehicle that.

How Much Should My Car Payment Be? A car loan is debt, and your total monthly debt payments should not be more than a third of your monthly take-home pay. % of monthly gross income is about the max. In other words, if you are already spending a lot per month on things like a mortgage and. Greg McBride, a senior vice president, chief financial analyst at info-shaman.ru, advises that a car payment should equal no more than 15 percent of your pretax. If you have to spend over 30% per month on rent, you'll have less money left over for bills and important purchases, making it more difficult to build savings. It depends on how much income you have after your bills and expenses. But as a rule of thumb, your car payment should not exceed 15% of your post-tax monthly. That puts average monthly car payments at $, $ and $, respectively. The price of used cars and trucks decreased. Used car and truck prices are down a. Greg McBride, a senior vice president, chief financial analyst at info-shaman.ru, advises that a car payment should equal no more than 15 percent of your pretax. Experts suggest that you should not allocate more than 20% of your take-home pay towards monthly auto payments. The down payment, interest rate, and term of. How much should you spend on a car? Experts recommend spending no more than 10–15% of your income on a car payment, so set your price from there and see what. “It's smart to spend less than 10 percent of your monthly take-home pay on your car payment,” according to Reed. For example, if your monthly paycheck is $3, When you factor each of these items into your monthly car payment you see that a $/mo car payment is actually $1,/mo. And this is where the 10% comes in. Another approach when budgeting for a car is to analyze your debt-to-income (DTI) ratio. This is the percentage of your monthly income that goes toward your. The amount that's left after your essential monthly expenses are accounted for is what you could feasibly afford to make as a car payment each month. Be sure to. How much should you spend on a car based on your income? As a rule of thumb, you should never spend anything more than % of your income. Generally, it is. The total cost of your finance payment and car running costs – including insurance, fuel, MOT, services, and more – should be no more than 15 % to 20% of your. Average auto loan rate for new cars With higher interest rates becoming the new norm, many car buyers are settling for higher monthly payments. The same. Use your monthly budget to estimate your maximum car price with our car affordability calculator. Adjust loan term, down payment, and trade-in value. Calculate the maximum car amount you can afford based on your preferred monthly payment with Autotrader's Car Affordability Calculator. This means that if you make $3, per month, you'll want to devote $ per month towards monthly payments for all of your vehicles. (Most people spend about.

Heat Map For Stock Market

The Sector Heatmap tracks the movement of the component stocks which makeup the 11 Sector SPDRs ETFs. Weight by capitalization, floating capitalization or weight. Heatmap NASDAQ The entire stock market is on MarketScreener. MT. Summary · Quotes · Charts. Yahoo Finance's most active stocks heatmap allows you to quickly gather all the data about today's most active stocks in a single glance! Generated At: Sep , Nifty Value , Change %, Fields: Equity Code / Price Change / Change %, Color By Price Change %, Order. The US Total Market Stock Heat Map (aka tree map) includes entries for + stockes and ADRs traded in the US stock markets and indexes of 11 market sectors. They are called Heatmaps and others have suggested Finviz, but you can just google „stock market heatmap“ and find these. TradingView also has a cool one. Stay up-to-date on stock market indices and sectors, including S&P , Dow Jones, and local indices. Find out the stock trends of domestic and foreign companies by searching for a country or stock index. • View the heatmap based on market cap, trading value. Stock Heat Map Professional Edition App (Stock Map Pro) contains six stock market heat maps in one app. It features the Total Market map, S&P two-level map. The Sector Heatmap tracks the movement of the component stocks which makeup the 11 Sector SPDRs ETFs. Weight by capitalization, floating capitalization or weight. Heatmap NASDAQ The entire stock market is on MarketScreener. MT. Summary · Quotes · Charts. Yahoo Finance's most active stocks heatmap allows you to quickly gather all the data about today's most active stocks in a single glance! Generated At: Sep , Nifty Value , Change %, Fields: Equity Code / Price Change / Change %, Color By Price Change %, Order. The US Total Market Stock Heat Map (aka tree map) includes entries for + stockes and ADRs traded in the US stock markets and indexes of 11 market sectors. They are called Heatmaps and others have suggested Finviz, but you can just google „stock market heatmap“ and find these. TradingView also has a cool one. Stay up-to-date on stock market indices and sectors, including S&P , Dow Jones, and local indices. Find out the stock trends of domestic and foreign companies by searching for a country or stock index. • View the heatmap based on market cap, trading value. Stock Heat Map Professional Edition App (Stock Map Pro) contains six stock market heat maps in one app. It features the Total Market map, S&P two-level map.

Discover potential trading opportunities with our Future and Option Heatmap. Visualize market trends and make informed decisions only at Research The sample stock heat map is a custom visualization that provides a visual representation of stock market data. Heat maps are often used in financial analysis to represent data such as stock prices, trading volumes, or market trends. Heat maps allow analysts to quickly. A stock heatmap provides a graphical representation of the financial market's activity. At its core, it's designed to give investors a quick overview of what's. The Bookmap heatmap shows you where liquidity is in the market. It helps traders to determine where the actual orders in the market are being made. The Heatmap illustrated on the chart is a range that is determined by analyzing the price action in between the two “Truth in Analysis” lines (similar to how. A heatmap is a graphical representation of data in two-dimension, using colors to demonstrate different factors. · Heatmaps are a helpful visual aid for a viewer. Find the variation of Index S&P sorted by sector. Weight by capitalization, floating capitalization or weight. Heatmap S&P The entire stock market. A Stock Heatmap allows investors to focus on specific individual stocks. If you're deeply interested in particular companies or industries, this. Get to know how the market is trending as a whole using our heatmap. You can filter the map based on market cap. Use the scroll wheel to zoom in and out. The heat map shows the stocks in the selected index or sector, showing the percent change for the selected time frame. View the heatmap based on market cap, trading value, and short-selling. Get information on foreign stocks of 19 countries including the United States, China. Market Heatmap Degree Market View: Get the detailed view of the stocks included in market indices. Market Heatmap Advance Decline Ratio on Moneycontrol. The Sector Heatmap tracks the movement of the component stocks which makeup the 11 Sector SPDRs ETFs. Live Heat Map for F&O. Market Action by All Futures, All Options, Index Futures, Index Options, Stock Futures, Price, Volume, Open Interest, Open Interest. The info-shaman.ru heatmaps to see p/c ratios, stock changes during the day, and more. The Heatmap NSE is a visual tool using colors to show Nifty stock movements. In this representation, green tiles indicate rising stocks, while red tiles signify. This widget shows off a macro view on global stocks. Perfect for segmenting by sector, country or market cap. Stay up-to-date on stock market indices and sectors, including S&P , Dow Jones, and local indices. Stock Heat Map The Stock Heat Map provides a visual representation of market performance, offering insights into the relative strength and weakness of various.

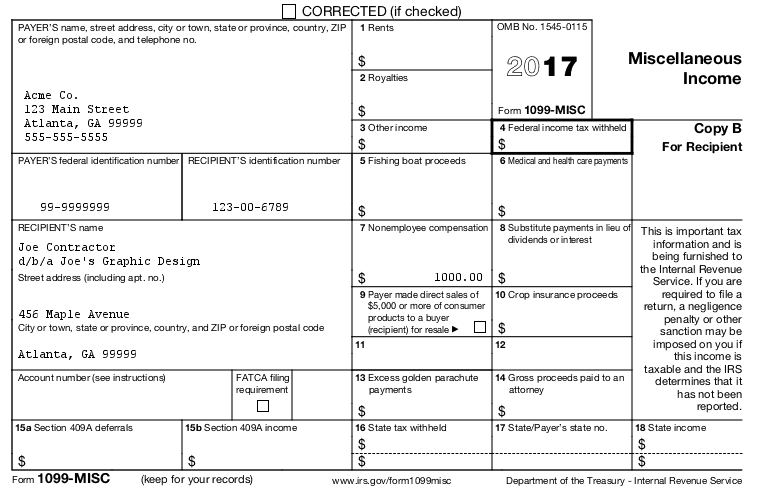

Do You Have To File A 1099 Misc

You'll usually report this income on Form , Line 21, as Other income. This is taxable income not subject to self-employment tax. If a business paid you more than $ in legal settlements, rent payments or prizes and awards, it will need to file form MISC , because these are all. Yes. However, Form MISC is required to be filed only in cases where the payment made meet all of the following conditions: a. the payment amounts to $1. You are likely an independent contractor if you performed work for a business, individual, or any other organization and you received a Form MISC for your. The filing deadline for W-2s and s is February · W-2s and s must be filed using GovConnectIowa. · What Permit Number should you use to file? Am I required to file information returns (s)?. Only file s with the SCDOR if you withheld South Carolina Income Tax. Do not send s to the. SCDOR. For MISC forms, the IRS requires filing if the amount of total reportable payments is $ or more. Filing requirements for some states might differ from. If the entity you paid for services is an S-Corp or C-Corp, you do not need to issue a NEC unless the payment was for legal services. Legal services are. Form MISC stands for "miscellaneous information" and is used to report various forms of payments over $ to the IRS. You'll usually report this income on Form , Line 21, as Other income. This is taxable income not subject to self-employment tax. If a business paid you more than $ in legal settlements, rent payments or prizes and awards, it will need to file form MISC , because these are all. Yes. However, Form MISC is required to be filed only in cases where the payment made meet all of the following conditions: a. the payment amounts to $1. You are likely an independent contractor if you performed work for a business, individual, or any other organization and you received a Form MISC for your. The filing deadline for W-2s and s is February · W-2s and s must be filed using GovConnectIowa. · What Permit Number should you use to file? Am I required to file information returns (s)?. Only file s with the SCDOR if you withheld South Carolina Income Tax. Do not send s to the. SCDOR. For MISC forms, the IRS requires filing if the amount of total reportable payments is $ or more. Filing requirements for some states might differ from. If the entity you paid for services is an S-Corp or C-Corp, you do not need to issue a NEC unless the payment was for legal services. Legal services are. Form MISC stands for "miscellaneous information" and is used to report various forms of payments over $ to the IRS.

File your with the IRS for free. Free support for self-employed income, independent contractor, freelance, and other small business income. According to the IRS, Form MISC is used to report miscellaneous payments made in the course of business or trade in a tax year. Business taxpayers use this. All individuals, businesses and corporations who are required to make a federal information report must file with the Missouri Department of Revenue an. Since the IRS considers any payment as taxable income, you are required to report your payment on your tax return. For example, if you earned less. If you rent residential property to non-businesses don't expect to receive a Form MISC with rents reported in box 1 Individuals are not required to issue. IRS requires MISC to be filed by February 28 (paper) or March 31 (electronic). Give vendors their copies by January To read more about how to file in. After You File. Check E-File Status · Print / Download My Return · StartSign Do I have to enter a MISC? How do I attach my MISC to a business. You'll usually report this income on Form , Line 21, as Other income. This is taxable income not subject to self-employment tax. You do not need to file a Form MISC if your payments are below the minimum reporting threshold. For most transaction types, the threshold is $ You are. Any other form that indicates Michigan withholding must be filed with Michigan (including Form K). Why would there be withholding on a ? The IRS. To complete a MISC, you'll need to supply the following data: Business information – Your Federal Employer ID Number (EIN), your business name and your. The IRS issues some TINs like an employer identification number (EIN) and individual taxpayer identification number (ITIN) for resident aliens receiving Form. Generally, the payer of the miscellaneous income does not withhold income tax or Social Security and Medicare taxes from the miscellaneous income. IRS. Other business types, such as certain corporations, are exempt from MISC reporting. The second factor depends on the type of payment made to you. The IRS. The recipient's copy of Form NEC or MISC must be sent by January 31, , or send Form MISC by February 15, , if amounts are reported in. The IRS issues some TINs like an employer identification number (EIN) and individual taxpayer identification number (ITIN) for resident aliens receiving Form. Both Form NEC and Form MISC refer to different types of payments sent to nonemployees, either as nonemployee compensation or other payments that will. Employers are required to send the form MISC to all contractors/freelancers they hired and paid before January 31st of the next year after completing the. Filing Form MISC can be done online or by mail. Use a third-party software or services compatible with the IRS FIRE (Filing Information Returns. I am required to file information returns (Forms MISC, NEC, and R) with the federal Internal Revenue Service (IRS). Am I required to send a.

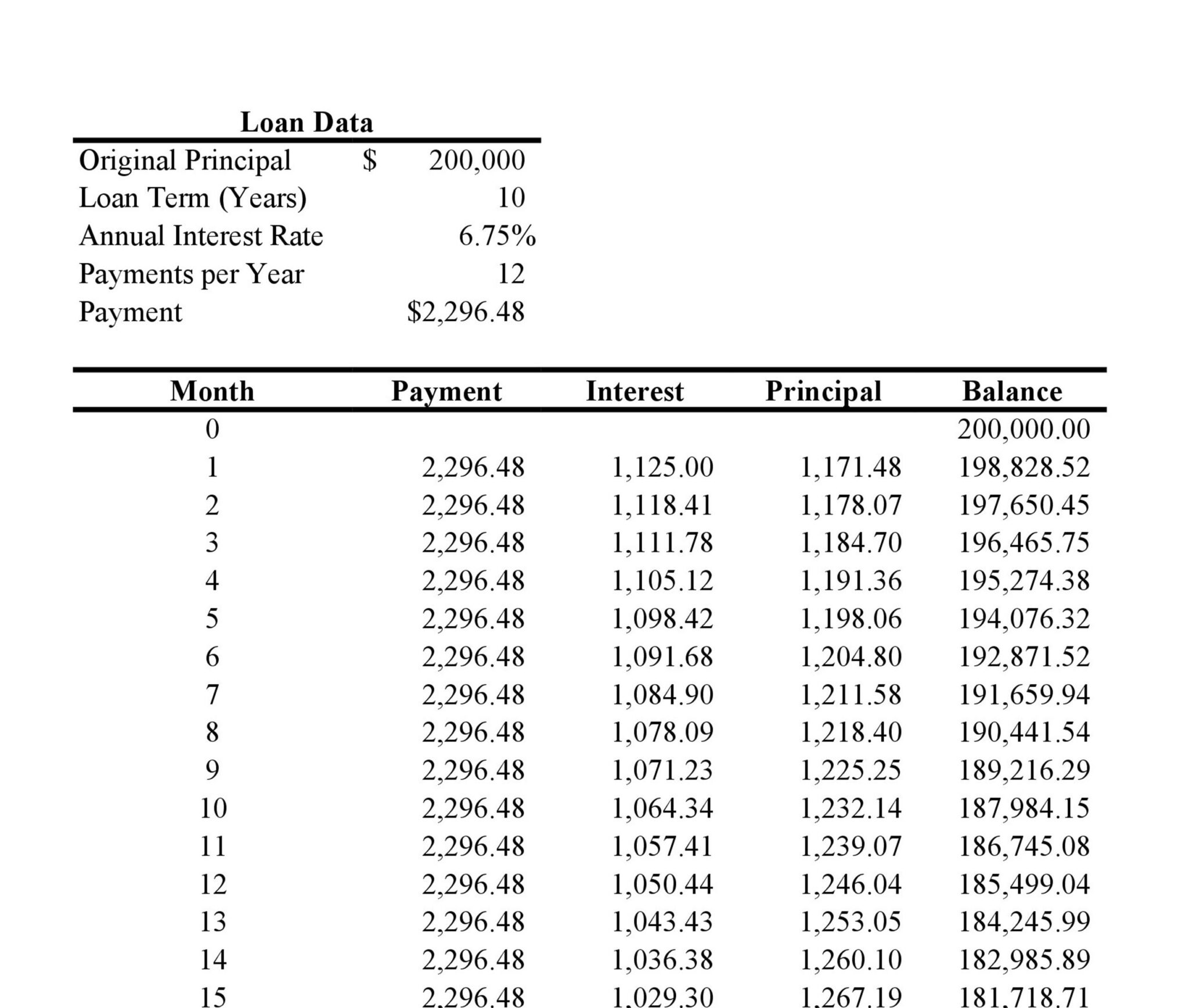

Payment Schedule For Mortgage

Mortgage payments · Monthly (12 payments per year) · Semi-Monthly (24 payments per year) · Accelerated Bi-Weekly (26 payments per year) · Weekly (52 payments per. Use this calculator to estimate your total mortgage cost and payment schedule. Enter some basic information to get started. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. An amortization schedule is a table that shows the amount of interest and principal you pay each month over time. In addition, the schedule will show you the. payment and shows you the corresponding amortization schedule Apply Prepayments. Lump Sum Payment(Annually), Mortgage Payment Increase(Each Payment). Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. Over the course of the year. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. Mortgage payments · Monthly (12 payments per year) · Semi-Monthly (24 payments per year) · Accelerated Bi-Weekly (26 payments per year) · Weekly (52 payments per. Use this calculator to estimate your total mortgage cost and payment schedule. Enter some basic information to get started. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. An amortization schedule is a table that shows the amount of interest and principal you pay each month over time. In addition, the schedule will show you the. payment and shows you the corresponding amortization schedule Apply Prepayments. Lump Sum Payment(Annually), Mortgage Payment Increase(Each Payment). Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. Over the course of the year. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time. Figure out how to calculate your mortgage amortization. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time.

Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. Calculate your mortgage payment amount and the impact of optional additional prepayments. Use the amortization schedule to find out the principal and interest. However, shorter and longer time frames may be available depending on the amount of your down payment. A shorter amortization can save you money as you pay less. Mortgage calculator with amortization schedule. Principal, Amortization months. Help. Interest Rate, Payment. Annual, Semi-annual, Monthly, Bi-weekly, Weekly. Accelerated weekly and accelerated bi-weekly payment options are calculated by taking a monthly payment schedule and assuming only four weeks in a month. We. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Our mortgage calculator reveals your monthly mortgage payment, showing both principal and interest portions. See a complete mortgage amortization schedule. It's a chart that shows you how much of each payment will go toward interest and principal—until you pay off the house! Amortization Period vs. Mortgage Term. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. The payment frequency can be annual, semi-annual. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. A year fixed-rate mortgage has a higher. An amortization schedule shows how the proportions of your monthly mortgage payment that go to principal and interest change over the life of the loan. An amortization schedule is a table that displays each payment for your loan under a structured plan, detailing how each installment covers both interest and. Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. Mortgage payment schedule. placeholder. Totals. Principal. $. An amortization schedule is a data table that shows the progress of you paying off your mortgage loan. A term payment plan is an option for receiving reverse mortgage proceeds that gives the homeowner equal monthly payments for a set period of time. Due to its. The report will display your payment schedule. Annually will summarize payments and balances by year. Monthly will show every payment for the entire term.

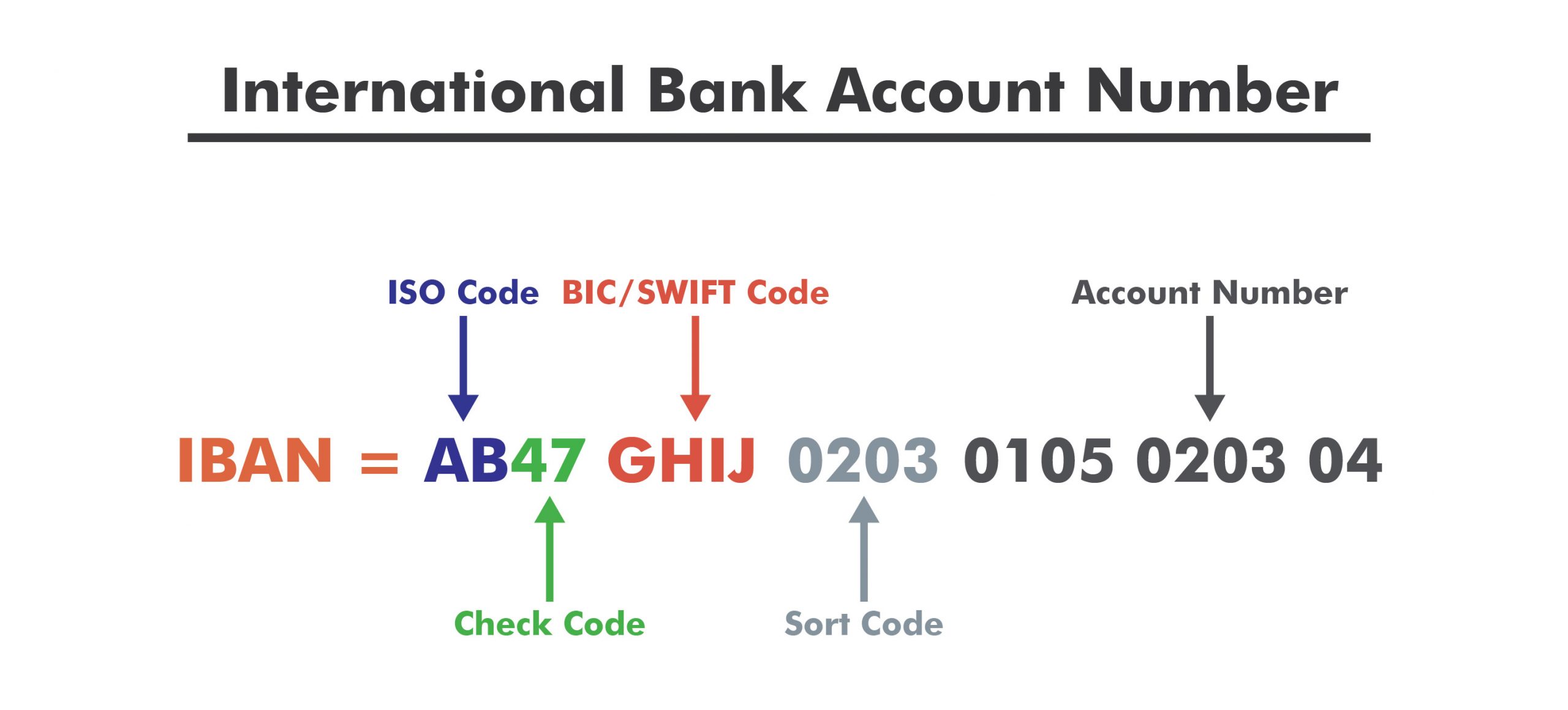

How To Find Bank Account

Get routing numbers for Wells Fargo checking, savings, prepaid card, line of credit, and wire transfers or find your checking account number. details on upcoming conferences and events. Find More FDIC News · Press Bank Customer, Banker, Consumer, Small Business Owner, Analyst/Researcher. You can find your bank account number on your bank statements, printed at the bottom of a paper check, or by logging on to the bank's website. If you can't find. Important: You need your savings account number (e.g., Member Share Savings) to enroll in Online Banking. You can find your savings account number on your. The number is found most of the times at the top of the statement. Each bank has its format for the statements. NetBanking: another simple method is to utilise. Call your bank. You'll need to identify yourself to get your account number. · Go online. Many banks post their routing numbers, by state, on their websites. To. Find Your Account Number with Online Banking · Log into Online Banking · Select an account from The Hub · Click on Account Numbers and More · The account number. You can find your account number in the top of the right column of a bank statement. In the example, you would use 34 to determine your routing number using the. A bank account number helps identify your account and can be found multiple ways. Learn how you can find/protect your bank account number and much more. Get routing numbers for Wells Fargo checking, savings, prepaid card, line of credit, and wire transfers or find your checking account number. details on upcoming conferences and events. Find More FDIC News · Press Bank Customer, Banker, Consumer, Small Business Owner, Analyst/Researcher. You can find your bank account number on your bank statements, printed at the bottom of a paper check, or by logging on to the bank's website. If you can't find. Important: You need your savings account number (e.g., Member Share Savings) to enroll in Online Banking. You can find your savings account number on your. The number is found most of the times at the top of the statement. Each bank has its format for the statements. NetBanking: another simple method is to utilise. Call your bank. You'll need to identify yourself to get your account number. · Go online. Many banks post their routing numbers, by state, on their websites. To. Find Your Account Number with Online Banking · Log into Online Banking · Select an account from The Hub · Click on Account Numbers and More · The account number. You can find your account number in the top of the right column of a bank statement. In the example, you would use 34 to determine your routing number using the. A bank account number helps identify your account and can be found multiple ways. Learn how you can find/protect your bank account number and much more.

Find your U.S. Bank routing number and account number in online banking, the mobile app, on a check or monthly statement - How to find your routing number. Get information on your Bank of America Account and profile. Find your account number and learn how to link accounts, close accounts and more. banking system. Need to find or validate an ABA Bank Routing Number? Visit the online lookup. Where is the ABA Routing Number on my checks? You can find the. My Lost Account is a FREE service that helps you trace your lost accounts and savings Did you know there are over million bank and building society. How to find accounts in your name · 1. Check your credit reports · 2. Review your online banking statements · 3. Contact financial and government institutions. Where is the account number on a check? For some, the easiest place to track down a bank account number is at the bottom of a check. In particular, if you open. We may evaluate accounts periodically to determine qualifications and have the right to remove benefits based on failure to meet qualifications. Benefits. Find your routing and account number by signing into the Chase Mobile® app and choosing your account tile, then choose 'Show details'—your bank account and. Alaska · Alliant Credit Union High-Rate Checking · Alliant Credit Union Teen Checking · Ally Bank Spending Account · BMO Smart Money Checking · Discover Bank®. Find our FAQ section to help you with the process of opening a checking or savings account today. Discover forgotten bank accounts in your name with our step-by-step guide. Reclaim your lost funds today! It's the second set of numbers printed on the bottom of your checks, just to the right of the bank routing number. If you don't have your checkbook handy, don't. How do I find my account and routing number? · Choose the account you'd like to view, then select the Manage tab at the top. · Under Account Details, select. If you have misplaced your ATM/debit card and need time to find it, you can temporarily lock your card right from your Mobile Banking app or through Online. First, go to a local branch and show an ID and your debit/ATM card, they can give you your account number. Second, log onto your bank's. Learn how to find these using our mobile app, online banking, a check or view the Routing Number for Wire Transfers, ACH, and Check Order. You'll need these. You can always use one of your M&T Bank checks or a withdrawal ticket to find your routing number. It will be in the bottom-left corner, listed first before. The interest they pay for savings accounts. You usually need to make an initial deposit between $25 and $ to open a savings or checking account. Tip. Find. Probably not. You'll need to go to one of the bank's branches and speak to one of their customer service representatives. They will ask you to. Find a bank account with the features you need to pursue your financial goals. Explore options from Bank of America and open a bank account online today.

What Are Balance Transfer Cards

A balance transfer means moving all or part of the debt from one or more credit cards to another credit card. The takeaway. If you are someone who is serious about getting ahead of your payments, a balance transfer is a great option. By having a lower APR, you can allow. Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower interest rate. It's all about transferring a high-interest credit card balance to a new, low-interest card, and it has the potential to save you a lot of money in the long. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. Learn about balance transfer credit cards, how they work, how to apply, and if you should get a balance transfer card to help pay off your credit card debt. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. A balance transfer means moving all or part of the debt from one or more credit cards to another credit card. The takeaway. If you are someone who is serious about getting ahead of your payments, a balance transfer is a great option. By having a lower APR, you can allow. Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower interest rate. It's all about transferring a high-interest credit card balance to a new, low-interest card, and it has the potential to save you a lot of money in the long. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. Learn about balance transfer credit cards, how they work, how to apply, and if you should get a balance transfer card to help pay off your credit card debt. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe.

You can simplify your monthly payments, pay off your balance faster and save big on interest. It's easy to do and there's no transfer fee. A balance transfer allows you to transfer the outstanding balance owed to your current credit card issuer to another card at a lower interest rate. Much like it sounds, a balance transfer is the process of taking the balance of one or more credit card(s) and transferring it to a brand new credit card as a. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a card. A balance transfer is the transfer of (part of) the balance (either of money or credit) in an account to another account, often held at another institution. Discover Mastercard's best balance transfer credit card options. Explore Mastercard credit cards to find the right card for your lifestyle needs. 5. Does SDFCU do balance transfers? If you already have one of our cards and you want to consolidate your other card balances to your SDFCU credit card, you. A balance transfer is a simple way to keep all of your outstanding balances, payments, and due dates together under one card. What is a balance transfer? You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee. Learn how balance transfers can help manage existing credit card borrowing by moving high-interest balances to a low interest rate credit card. A balance transfer is a method of debt consolidation where you combine existing credit card debt and other qualifying debts within one single credit card. This. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Balance transfer credit cards let you consolidate your debt while helping you save on interest charges. And at info-shaman.ru, finding the best balance. A TD Balance Transfer lets you use available credit from your TD Credit Card Account to pay the balance owing (in full or in part) on a non-TD Credit Card such. A balance transfer lets you move unpaid debt—like credit card balances, personal loans, student loans and car loans—from one or more accounts to a new or. Moving your balance from one credit card to another. Do Balance Transfers impact credit score? Definition of Balance Transfer. This is a way to move the. Balance transfer fees can typically range anywhere from 3% to 5% of the amount of each transfer, with a minimum of $5 or $ You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. You have an offer to transfer that balance to a card with a generous 0% intro/introductory APR for 18 months with a 3% balance transfer fee. With the same $

What Is The Average Cost Of Pet Insurance

On average, across different ages, breeds, and locations, Lemonade pet parents pay around $47/month to keep their pups covered. How much is pet insurance for. How much does pet insurance cost? According to the National American Pet Health Insurance Association, the average cost of pet health insurance ranges from. The average cost of dog insurance hovers around $88 per month, according to quotes analyzed by Investopedia. But much like our canine companions, rates vary. The actual cost can range widely, with lifetime pet insurance for dogs costing anywhere from £10 to £ a month (£ to £1, a year) or more. These costs. Veterinary medicine can do amazing things for pets these days, but the costs for scans and other treatments can quickly add up. Allstate pet health insurance. veterinary costs. You can get it for your dog or cat. The USAA Insurance Average claims cost based on Embrace claims data. Depending on the. The average cost for pet insurance is $ per month for dogs and $ per month for cats. · The species, breed, age, and location of your pet, plus policy. Average Premiums (U.S.) ; DOG, Annual: $ Monthly $, Annual: $ Monthly $ ; CAT, Annual: $ Monthly $, Annual: $ How Much Is Pet Insurance? On average, dog insurance costs $47 per month and cat insurance costs $29 per month. Your actual costs may be higher or lower. On average, across different ages, breeds, and locations, Lemonade pet parents pay around $47/month to keep their pups covered. How much is pet insurance for. How much does pet insurance cost? According to the National American Pet Health Insurance Association, the average cost of pet health insurance ranges from. The average cost of dog insurance hovers around $88 per month, according to quotes analyzed by Investopedia. But much like our canine companions, rates vary. The actual cost can range widely, with lifetime pet insurance for dogs costing anywhere from £10 to £ a month (£ to £1, a year) or more. These costs. Veterinary medicine can do amazing things for pets these days, but the costs for scans and other treatments can quickly add up. Allstate pet health insurance. veterinary costs. You can get it for your dog or cat. The USAA Insurance Average claims cost based on Embrace claims data. Depending on the. The average cost for pet insurance is $ per month for dogs and $ per month for cats. · The species, breed, age, and location of your pet, plus policy. Average Premiums (U.S.) ; DOG, Annual: $ Monthly $, Annual: $ Monthly $ ; CAT, Annual: $ Monthly $, Annual: $ How Much Is Pet Insurance? On average, dog insurance costs $47 per month and cat insurance costs $29 per month. Your actual costs may be higher or lower.

Pet owners trust Nationwide to protect more than 1,, pets · Pet insurance premiums starting at $25/mo. · Visit any licensed veterinarian in the United. On average, it costs $ to $ a year to insure a dog and $ to $ a year for cat insurance. Weigh your options carefully before buying a policy. Review. The cost of pet insurance varies based on several factors, such as where you live and your pet's age. Find out how to keep your pet and wallet protected. According to our internal Embrace Pet Insurance data, we covered over 20, claims in Ohio in at an average cost of $ per claim. We find that Ohio pets. The average cost of dog insurance is $ per month, according to premium quotes analyzed by Investopedia. The average annual cost of owning a dog is $ a month or $4, a year, according to a recent survey of 1, U.S. dog owners. · Dog owners from ages 18 to 78+. The average cost of surgical care for a dog is about $, and for cats it's about $ That could take a bite out of your wallet. With the right pet medical. It is financially better on average to NOT have insurance, because insurance Yeah - my cats pet insurance costs $20 a month. That's $ a. While the average cost of pet insurance is $46 per month (according to the North American Pet Health Insurance Association), many factors affect how much you'll. veterinary costs. You can get it for your dog or cat. The USAA Insurance Average claims cost based on Embrace claims data. Depending on the. I have had many, many pets, only two who were purebreds, which I bought. My babies that I paid for were much more sickly than my rescues. According to an analysis by Forbes Advisor, the average monthly cost of pet insurance for dogs is $44, and for cats, it is $ “The average monthly cost of pet insurance is $49 for dogs and $29 for cats. These are for plans that cover both accidents and illnesses. The range of average. Generally, the monthly costs might be more than $ or as low as just $10, with average costs ranging from $30 to $ This means that, on an annual basis. On average, accident and illness coverage costs $56 per month for dogs and $32 for cats across the U.S.. The cost of your premium will depend on your pet and. With Fetch, the average cost of dog insurance is $35 per month and the average cost of cat insurance is $20 per month. insurance premium on the average cost of veterinary care in the owner's region. For pets, insurance helps offset the sometimes high cost of primary pet. If you think you can't afford it, consider this: The average cost of veterinary expenses during a pet's lifetime is more than $13, Pet insurance can. The average cost of pet insurance for both dogs and cats has risen in recent years. In , the average cost of insuring a dog with an accident-and-illness. Generally, the monthly costs might be more than $ or as low as just $10, with average costs ranging from $30 to $ This means that, on an annual basis.

Lgi Homes Stock

Discover real-time LGI Homes, Inc. Common Stock (LGIH) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Interactive chart of historical stock value for LGI Homes over the last 10 years. The value of a company is typically represented by its market. Real time LGI Homes (LGIH) stock price quote, stock graph, news & analysis. Lgi Homes Stock FAQ · How much is Lgi Homes's stock price per share? (NASDAQ: LGIH) Lgi Homes stock price per share is $ today (as of Aug 16, ). How much percentage Lgi Homes, Inc. is up from its 52 Week low? Lgi Homes, Inc. (LGIH) share price is $ It is up by 1% from its 52 Week Low price of. LGI Homes, Inc. (info-shaman.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock LGI Homes, Inc. | Nasdaq: LGIH | Nasdaq. The 22 analysts offering price forecasts for LGI Homes have a median target of , with a high estimate of and a low estimate of Based on 6 Wall Street analysts offering 12 month price targets for LGI Homes in the last 3 months. The average price target is $ with a high forecast of. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Discover real-time LGI Homes, Inc. Common Stock (LGIH) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Interactive chart of historical stock value for LGI Homes over the last 10 years. The value of a company is typically represented by its market. Real time LGI Homes (LGIH) stock price quote, stock graph, news & analysis. Lgi Homes Stock FAQ · How much is Lgi Homes's stock price per share? (NASDAQ: LGIH) Lgi Homes stock price per share is $ today (as of Aug 16, ). How much percentage Lgi Homes, Inc. is up from its 52 Week low? Lgi Homes, Inc. (LGIH) share price is $ It is up by 1% from its 52 Week Low price of. LGI Homes, Inc. (info-shaman.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock LGI Homes, Inc. | Nasdaq: LGIH | Nasdaq. The 22 analysts offering price forecasts for LGI Homes have a median target of , with a high estimate of and a low estimate of Based on 6 Wall Street analysts offering 12 month price targets for LGI Homes in the last 3 months. The average price target is $ with a high forecast of. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change

On what stock exchange are LGI Homes' shares traded, and what is the ticker symbol? LGI Homes shares trade on the NASDAQ Global Market under the symbol. LGI Homes traded at $ this Wednesday September 4th, decreasing $ or percent since the previous trading session. Looking back, over the last four. Trade LGI Homes, Inc. - LGIH CFD ; Prev. Close, ; Open, ; 1-Year Change, % ; Day's Range, - LGIH Related stocks ; LGIH, , % ; LGI Homes Inc ; JOE, , +% ; St. Joe Company. Today's High; $ Today's Low; $ 52 Week High; $ 52 Week Low; $ Data Provided by Refinitiv. Minimum 15 minutes delayed. Track LGI Homes Inc (LGIH) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Historical daily share price chart and data for LGI Homes since adjusted for splits and dividends. The latest closing stock price for LGI Homes as of. See the latest LGI Homes Inc stock price (LGIH:XNAS), related news, valuation, dividends and more to help you make your investing decisions. LGI Homes Inc ; Apr, Downgrade, Wedbush, Neutral → Underperform, $88 → $74 ; Oct, Upgrade, BTIG Research, Sell → Neutral. Stock analysis for LGI Homes Inc (LGIH:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. What Is the LGI Homes Stock Price Today? The LGI Homes stock price today is · What Is the Stock Symbol for LGI Homes? The stock symbol for LGI Homes is ". Affordable single-family home construction company LGI Homes (NASDAQ:LGIH) fell short of analysts' expectations in Q2 CY, with revenue down % year on. A high-level overview of LGI Homes, Inc. (LGIH) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and. LGI Homes (LGIH) · Previous Close · $ · ; % · Volume: , · Volume % Chg: 16% · Get a Leaderboard Chart for LGIH ·? See How IBD Rates. LGIH. LGI Homes ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. N/A. LGI Homes, Inc. engages in the design, construction, marketing, and sale of new homes. It focuses on the residential land development business. In recent trading, shares of LGI Homes, Inc. have crossed above the average analyst month target price of $, changing hands for $/share. LGIH. LGI Homes, Inc. designs, constructs, and sells homes. It offers entry-level homes, such as attached and detached homes, and active adult homes under the LGI. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. LGI Homes, Inc. is followed by the analysts listed. Please note that any Footer Links. Press Releases · Events & Presentations · Stock · Governance · ESG.