info-shaman.ru Market

Market

Healthy Finances

Our Top 5 Money Management Tips for Healthy Finances · Determine Your Short and Long-Term Financial Goals · Create a Budget · Build an Emergency Fund. How improving financial issues may improve your health · 1. Tackling debt can lead to better sleep and fewer headaches · 2. Increasing financial literacy can. 1. Set meaningful goals to build good financial habits · Pay off $30, of debt in five years · Save $6, for vacation in 11 months · Invest $3, in four. Financial health for strong futures · Aspiring homeowners can learn from our loan officers about budgeting, saving for a down payment and how the mortgage. Financial wellness is your ability to live a healthy financial life. It is the power to take control of your financial health now and into the future. You. Get to know the healthy finance videos that Triple-S has for you. Finance expert Mara Liz Meinhofer shares her financial guidance during the pandemic. Want to develop good financial habits in ? Here are 5 healthy financial habits to create, from reviewing spending habits to checking credit cards and. Financial education resources to help you achieve your financial goals. No matter where you are in your financial journey, Wells Fargo is there to help you. Financial Health: 10 Simple Ways to Stay Financially Healthy · 1. Limit Your Expenses · 2. Create a Monthly Budget · 3. Build an Emergency Fund · 4. Set. Our Top 5 Money Management Tips for Healthy Finances · Determine Your Short and Long-Term Financial Goals · Create a Budget · Build an Emergency Fund. How improving financial issues may improve your health · 1. Tackling debt can lead to better sleep and fewer headaches · 2. Increasing financial literacy can. 1. Set meaningful goals to build good financial habits · Pay off $30, of debt in five years · Save $6, for vacation in 11 months · Invest $3, in four. Financial health for strong futures · Aspiring homeowners can learn from our loan officers about budgeting, saving for a down payment and how the mortgage. Financial wellness is your ability to live a healthy financial life. It is the power to take control of your financial health now and into the future. You. Get to know the healthy finance videos that Triple-S has for you. Finance expert Mara Liz Meinhofer shares her financial guidance during the pandemic. Want to develop good financial habits in ? Here are 5 healthy financial habits to create, from reviewing spending habits to checking credit cards and. Financial education resources to help you achieve your financial goals. No matter where you are in your financial journey, Wells Fargo is there to help you. Financial Health: 10 Simple Ways to Stay Financially Healthy · 1. Limit Your Expenses · 2. Create a Monthly Budget · 3. Build an Emergency Fund · 4. Set.

healthy financial future. In short: financially resilient, confident and empowered. People who experience financial wellbeing are less stressed about money. Investing in growth. Sound financial health helps set the foundation for strong and resilient households, communities and economies. We want to help people. Financial problems adversely impact your mental health. The stress of debt or other financial issues leaves you feeling depressed or anxious. The decline in. Start managing your personal finances and making smart financial decisions today 1. J.D. Power Financial Health Support CertificationSM is based on. 8 Healthy Financial Habits You Should Develop · 1. Embrace Living Within Your Means · 2. Budget Responsibly · 3. Adjust Your Expenses & Earnings · 4. Create an. Seven simple health checks · 1. Assess your cash situation · 2. Look at spending habits · 3. Switch utility and broadband suppliers · 4. Check your pensions and. Answer the questions and get your score. You won't be asked about any personal financial data—it's not that kind of questionnaire. Healthy finances do lead to a healthier life. Taking steps towards better financial preparedness can help you feel more in control and relieve stress. And, as. By Leo Babauta · Sit down and talk about financial goals and values. · Remove emotions from financial talk. · Come up with a plan to meet your goals. · Develop. The Amalgamated—Healthy Finances workshops are back! Bringing you our new NAMI-NYC mental health series. Do you wish you knew more about how to improve your. 10 healthy financial habits for college students · 1. Take a money inventory · 2. Set a budget and track expenses · 3. Open a savings account in addition to a. There's never a bad time to take a closer look at your finances and think about your goals for the future. Check out these nine healthy financial habits! Thinking about how to improve your financial position can be daunting. Where to start? What to review? How to plan? · Spend less than you earn · Stick to a. “Financial stress can and does lead to individuals adopting unhealthy coping mechanisms; examples would be overeating, smoking and using alcohol/ recreational. Financial education resources to help you achieve your financial goals. No matter where you are in your financial journey, Wells Fargo is there to help you. On the Road to Healthier Finances. AFSA introduces FELA, Financial Education & Literacy Advisers (FELA) offers a complimentary, online financial education. In this CEU, we'll cover the basics of personal finance – budgeting, saving, debt payoff, and investing – through the lens of Behavior Analysis. Research shows. Stress about money and finances may have a significant impact on Americans' lives. Read up on financial well-being health tips. Healthy Living with AIA. Healthy Finances. More articles on Healthy Finances. Two young lady taking a break from shopping. ARTICLE. Navigating Financial Peer. Healthy Finances refer to a state of financial well-being. A team of researchers assembled by the Consumer Financial Protection Bureau (CFPB) suggests financial.

What Day Of The Week Are Flights Cheapest

According to Expedia and the ARC, Sundays are the best days to be buying your flights - you can often save up to 13% from the Friday price - with Tuesday being. Hopefully, you globetrotters marked your calendars for Cheap Flight Day, August 23, well in advance. While many people associate late-August with back to school. Generally, Mondays and Fridays are more expensive than Tuesdays, Wednesdays and Thursdays. Keyes says this is mainly because business travelers tend to avoid. week and even day you decide to purchase your ticket. You can find the Flights also tend to be cheaper if you plan to fly on a weekday. Are there. Travelers who search for flights at midnight of the first half of the week, get cheap airfares in comparison to the remaining days. In general, flights are. Frequent travelers may already know this, but earlier in the week can be the cheapest time to fly. In , flights departing on a Monday were generally the. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will. flights, packing efficiently, and utilizing the best travel tools. What is the cheapest day of the week to book a flight? The best day to book your flight. In general, the day of the week when you book your ticket won't impact the price, but the days of the week on which you choose to travel will. Choosing a less. According to Expedia and the ARC, Sundays are the best days to be buying your flights - you can often save up to 13% from the Friday price - with Tuesday being. Hopefully, you globetrotters marked your calendars for Cheap Flight Day, August 23, well in advance. While many people associate late-August with back to school. Generally, Mondays and Fridays are more expensive than Tuesdays, Wednesdays and Thursdays. Keyes says this is mainly because business travelers tend to avoid. week and even day you decide to purchase your ticket. You can find the Flights also tend to be cheaper if you plan to fly on a weekday. Are there. Travelers who search for flights at midnight of the first half of the week, get cheap airfares in comparison to the remaining days. In general, flights are. Frequent travelers may already know this, but earlier in the week can be the cheapest time to fly. In , flights departing on a Monday were generally the. From the US, the cheapest day to book a flight is said to be either Tuesday or Wednesday. International flights are usually cheaper on weekdays, while you will. flights, packing efficiently, and utilizing the best travel tools. What is the cheapest day of the week to book a flight? The best day to book your flight. In general, the day of the week when you book your ticket won't impact the price, but the days of the week on which you choose to travel will. Choosing a less.

You can find cheap flights any day of the week. The key to finding the best prices is to book early and be flexible. Usually, the earlier you book your plane. For instance, according to Expedia's Travel Hacks Report, Sunday is the best day of the week to find cheaper flights—and has been for the past 5 years. week and even day you decide to purchase your ticket. You can find the Flights also tend to be cheaper if you plan to fly on a weekday. Are there. You can find cheap flights any day of the week. The key to finding the best prices is to book early and be flexible. Usually, the earlier you book your plane. The cheapest day of the week to book a flight is Tuesday. Or is that just a false hope desperate travelers cling to in a bid to make the insanity of flight. How much is the cheapest flight to Houston? Prices were available within the past 7 days and start at $29 for one-way flights and $58 for round trip, for the. What is the cheapest day to buy plane tickets? Any day of the week. Booking on one day versus another isn't going to make a difference. "That used to be true;. The Cheapest Day to Buy an International Flight is on a Thursday. Believe it or not, the day on which you search for and book your international flight has a. $39 return flights and $20 one-way flights to United States of America were the cheapest prices found within the past 7 days, for the period specified. Prices. The short answer is that there is no golden rule to which day is the cheapest day to fly. That being said, while on your flight search, keep an extra eye on. For domestic travels, the cheapest day to travel depends on the airport, but for international flights, it's mostly Friday and Thursday. Experts warn against. Based on 20global flight data for Economy tickets, prices usually start to increase 56 days before departure for domestic flights. When traveling. According to our data, Sunday is the cheapest day of the week to book flights, but once again, it depends on your destination. If you are flexible around what. Airfare calendar - search cheapest day for air travel with info-shaman.ru Find cheapest flight tickets between two cities of India through airfare. Cheapest flights this weekend. Depart Friday evening, return Sunday evening · Kenmore Air Harbor Seaplane Base · Seattle Tacoma International Airport · Ganges. To get the cheapest flight possible, you probably won't get to fly at your preferred time of day. Simply put, the best time of day to fly is when no one else. Tuesday is by far the cheapest day to make the trip to London, so save on your flights while making a week of it and enjoy the lull before the storm that is. What is the cheapest day to buy plane tickets? Any day of the week. Booking on one day versus another isn't going to make a difference. "That used to be true;. You can find cheap flights any day of the week. The key to finding the best prices is to book early and be flexible. Usually, the earlier you book your plane. +/- 3 Days Shows prices 3 days before and after your chosen travel dates. Whole Month Finds the cheapest day to fly in the whole month of your chosen travel.

How To Count Cards In Poker

To count cards, use the Hi-Lo strategy to track the ratio of high cards to low cards. Give the high cards a specific value (-1) and the low cards a specific. This article provides basic strategy for counting cards in seven card stud. Determining which cards are live is fairly simple. Counting cards during a Texas Holdem game involves a player calculating the probability that their strategy will work based on (1) the number of. Begin by counting your two cards, then dealer's up card. Count any hit cards for the players since those will be delivered face up. If a player doubles, s/he. Counting Poker Hands and Finding Probabilities by N. Rimmer the total number 2 pair - 2 cards of one rank, 2 cards of another rank and another card. How to Count Cards: An Instructional Guide to Counting Cards in Blackjack for Significantly Improved Odds [Rhone, Dominique] on info-shaman.ru A good rule of thumb is to increase your bet one increment (by $x constantly) for each count over 0. A high count means that there are more low cards that have. The most basic card count is what is often referred to as a high low system. This means that you assign the low and the high cards different values. The values. Calculate your true count by dividing the running count by the decks. Casinos typically use multiple decks to try and prevent card counters from gaining an. To count cards, use the Hi-Lo strategy to track the ratio of high cards to low cards. Give the high cards a specific value (-1) and the low cards a specific. This article provides basic strategy for counting cards in seven card stud. Determining which cards are live is fairly simple. Counting cards during a Texas Holdem game involves a player calculating the probability that their strategy will work based on (1) the number of. Begin by counting your two cards, then dealer's up card. Count any hit cards for the players since those will be delivered face up. If a player doubles, s/he. Counting Poker Hands and Finding Probabilities by N. Rimmer the total number 2 pair - 2 cards of one rank, 2 cards of another rank and another card. How to Count Cards: An Instructional Guide to Counting Cards in Blackjack for Significantly Improved Odds [Rhone, Dominique] on info-shaman.ru A good rule of thumb is to increase your bet one increment (by $x constantly) for each count over 0. A high count means that there are more low cards that have. The most basic card count is what is often referred to as a high low system. This means that you assign the low and the high cards different values. The values. Calculate your true count by dividing the running count by the decks. Casinos typically use multiple decks to try and prevent card counters from gaining an.

First, you must memorize Basic Strategy and it must become second nature. Then you need to learn how to add the point values of all the cards that you see. Card counting in blackjack is a method for determining whether the next hand will be advantageous to the player or the dealer. Card Values/scoring While Poker is played in innumerable forms, a player who understands the values of the Poker hands and the principles of betting can play. Those make card counting ineffective. But for online live dealer blackjack games that don't use a “CSM,” they will have the dealer shuffle in the middle of the. Card counting is a blackjack strategy used to determine whether the player or the dealer has an advantage on the next hand. A blackjack game in progress. Rules: 3 card poker is played between the player's hand and the dealer's hand. This hot table game is fun but also easy to play. Learn how to play 3 card. Card Counter Lite is an exciting game based on real Blackjack card counting techniques. You love Blackjack and know what to do in every hand. I've never tried bringing a strategy card to a Spanish 21 table, but I'd be surprised if it caused a problem. David. Missing image. revereman. Posts count: Card counting works for those games where multiple rounds are dealt between shuffles. The AP is looking for a proprietary game or side bet where there are cards. (Some variant games use multiple packs or add a few cards called jokers.) The cards are ranked (from high to low) Ace, King, Queen, Jack, 10, 9, 8, 7, 6, 5. Card counting is a technique that lets blackjack players know when the advantage shifts in their favor. When this occurs, card counters will increase their bets. Card counting gives you an advantage of up to 1% in blackjack, which is enough to give you an edge over the house and make you a winning gambler in the long. Card counting gives you an advantage of up to 1% in blackjack, which is enough to give you an edge over the house and make you a winning gambler in the long. Counting Poker Hands. Poker: Poker is played with a 52 card deck. Each card has two attributes, a rank and a suit. The rank of a card can be any of Begin by counting your two cards, then dealer's up card. Count any hit cards for the players since those will be delivered face up. If a player doubles, s/he. To count cards, use the Hi-Lo strategy to track the ratio of high cards to low cards. Give the high cards a specific value (-1) and the low cards a specific. Card counting involves adjusting your play (and bets) according to what cards remain in the shoe. In order to get an idea of what's left, you need to mentally. How to Count Cards: An Instructional Guide to Counting Cards in Blackjack for Significantly Improved Odds [Rhone, Dominique] on info-shaman.ru Counting Cards Can Be Broken Into 4 Steps: · Step 1. Assign a value to every card · Step 2. Keep a “Running Count” based off of the values of the card dealt · Step. In truth, there is no way to count cards in poker as you do in blackjack. However, it could be used to help you count the number of outs you have remaining in.

Auto Loan Rates Canada

+ credit score – You'll qualify for the lowest rates, likely under 6%. credit score – You'll get a good rate, usually around %. credit. The average annual interest rate on a car loan Canada is around 4% for new cars and 8% for used. The interest rate on a car loan varies based on several factors. According to Statistics Canada data, the average car loan interest rate has increased from % in July to % in April —an increase of Car loan interest rates in Canada are either fixed or variable. Fixed interest rates remain constant throughout the life of the loan. Your monthly payments will. Scotiabank is the #1 choice for vehicle financing in Canada1. Get up to $, for your next vehicle Here is HelloSafe's definitive guide to getting car loans in Canada. Compare rates. Check review. We will show you what to look out for and help you find the. Dealerships are saying %, most banks are saying go to the dealer unless you want a personal loan and I can't get the other options. Car Loan Payment Calculator. Calculate your car loan payments. Required Royal Bank of Canada Website, © Legal | Accessibility | Privacy. We use the vehicle's price, including taxes, to determine how much you may be able to borrow and your monthly payments. + credit score – You'll qualify for the lowest rates, likely under 6%. credit score – You'll get a good rate, usually around %. credit. The average annual interest rate on a car loan Canada is around 4% for new cars and 8% for used. The interest rate on a car loan varies based on several factors. According to Statistics Canada data, the average car loan interest rate has increased from % in July to % in April —an increase of Car loan interest rates in Canada are either fixed or variable. Fixed interest rates remain constant throughout the life of the loan. Your monthly payments will. Scotiabank is the #1 choice for vehicle financing in Canada1. Get up to $, for your next vehicle Here is HelloSafe's definitive guide to getting car loans in Canada. Compare rates. Check review. We will show you what to look out for and help you find the. Dealerships are saying %, most banks are saying go to the dealer unless you want a personal loan and I can't get the other options. Car Loan Payment Calculator. Calculate your car loan payments. Required Royal Bank of Canada Website, © Legal | Accessibility | Privacy. We use the vehicle's price, including taxes, to determine how much you may be able to borrow and your monthly payments.

For most Canadians, car loan interest rates hover between % and 10%. Although credit scores and credit histories are obviously major factors, other aspects. Average Auto Loan Interest Rates in Canada The national averages for Canadian auto loan interest rates are between % to 10% on a car loan. A few factors. Loan Connect's network of lenders currently provides loan terms of anywhere from 72 to 84 months, with APRs starting at % based on personal credit. However. Loan terms less than 78 months % - %, Loan terms between months % - %, Loan terms over 85 % - %. Borrow better with a private sale vehicle loan. We offer fixed and variable interest rates, along with a repayment schedule that fits your budget. The car finance rates for a new cars and trucks such as the new Dodge Ram can be as low as 0%, and rates for used cars typically start at %. Looking to buy a new car? We'll do the math for you. Scotiabank free auto loan calculator gives you estimate for car loan, monthly payment, interest rate. Interest rate options ; New, Used ; Down Payment, Minimum 20%, Minimum 25% ; Amortization period. Vehicles under $25, Maximum of 5 years. Vehicles over $25, Enter the vehicle price, down payment, and interest rate into our car finance calculator below. The calculator will give your estimated weekly, biweekly, or. Find out how much automobile you can buy based on your weekly, bi-weekly or monthly payment, or find out your loan payment based on your purchase price! For an Auto loan with a month term, your APR may be as low as % APR and as high as % APR for a model year To qualify for the lowest rate. In , the average car interest rate in Canada was %. Remember that this is an aggressive loan term, and the car finance rate in Canada you get may vary. As of May , Santander's new car loan rates start at % for terms up to 84 months. This is a little higher then rates from TD, RBC, Scotiabank, and. We'll walk you through the factors affecting what sort of loan you can acquire andhow it influences the auto loan interest rates you pay in Canada. car from a dealer, can I finance it with RBC? Yes! We offer the convenience of financing and competitive rates at over 4, dealerships in Canada. You can. If you're looking for auto financing, we offer competitive Line of Credit interest rates and affordable car loan rates, the ability to choose how much you'll. The average car loan interest rate in Canada is %. Bad credit borrowers pay on average % on their car loans. The average car loan term is 69 months for. We'll help you save money with competitive interest rates. Ask for a CIBC car loan at over 3, dealerships across Canada. Reduce your gas bill and carbon. Like temporary residents, you are eligible for financing with a 25% down payment when the loan exceeds $10, Make an appointment.

Best Place To Shop For Mortgage Rates

:max_bytes(150000):strip_icc()/howtoshopformortgagerates-ff42b7929dcb47a3b5b96d4a1319e581.jpg)

Your credit. Your individual credit profile also affects the mortgage rate you qualify for. Borrowers with a strong credit history and good score (at least ). TIP #1: If you are shopping for the best reverse mortgage interest rate, be sure first to compare the program's payment options, which are explained in detail. Since credit unions are nonprofit and member-owned, they're typically able to offer lower interest rates and fees on lending products, including home loans. You. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, A fixed-rate mortgage is a type of home loan where the interest rate Where's The Best Place To Buy A House In South Florida? TFCU has home buying. A mortgage point – sometimes called a discount point – is a one-time fee you pay to lower the interest rate on your home purchase or refinance. Here are the key. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. shop for a mortgage lender, helping you secure the best rates and terms. Discover how understanding your financial situation and comparing lenders can lead. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for Your credit. Your individual credit profile also affects the mortgage rate you qualify for. Borrowers with a strong credit history and good score (at least ). TIP #1: If you are shopping for the best reverse mortgage interest rate, be sure first to compare the program's payment options, which are explained in detail. Since credit unions are nonprofit and member-owned, they're typically able to offer lower interest rates and fees on lending products, including home loans. You. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, A fixed-rate mortgage is a type of home loan where the interest rate Where's The Best Place To Buy A House In South Florida? TFCU has home buying. A mortgage point – sometimes called a discount point – is a one-time fee you pay to lower the interest rate on your home purchase or refinance. Here are the key. View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation. shop for a mortgage lender, helping you secure the best rates and terms. Discover how understanding your financial situation and comparing lenders can lead. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for

Looking for the best mortgage rates? A great place to start is a mortgage calculator, which lets you estimate your monthly house payment and get a better. You also might find lenders that offer to let you make monthly payments where you pay only a portion of the interest you owe each month. So, the unpaid interest. Your local newspaper and the. Internet are good places to start shopping for a loan. You can usually find information both on interest rates and on points for. Ready to purchase a new home? View today's lowest mortgage rates to find the best loan type for you! Submit your online application today to get started. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. The more knowledgeable you are before you approach lenders, the better deal you're likely to get. Look in your local paper to see what rates are being offered. The easiest way to buy down your mortgage rate is to buy discount points. Each point is percent of your mortgage amount, and reduces your mortgage rate by. Armed with the knowledge of your financial standing, you will be in a better position to shop for a mortgage and find the best mortgage lender. See What You. You don't want someone where you have to play carnival tricks in order to get a decent deal.” As you're shopping for a mortgage, it's important to understand. Explore our mortgage marketplace where we compare thousands of loan options to find you the most competitive year fixed and year fixed mortgage rates. Rate is the single-biggest cost of a mortgage. Learn where to look for the cheapest mortgages and the factors you can control to be sure you're getting the. Looking for home mortgage rates in New York? View loan interest rates from local banks, NY credit unions and brokers, from info-shaman.ru They also assume the loan is for a single-family home as your primary residence and you will purchase up to one mortgage discount point in exchange for a lower. Our research showed that nearly half of homebuyers don't shop for better rates before taking out a mortgage to buy or refinance a home. locations. See. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Answer a few questions about your loan preferences to compare mortgage rates from multiple lenders. Where are you buying/refinancing? Get started. Rates can. Live mortgage rates and costs in seconds! · Your Best Rates Here · Connect with a Mortgage Advisor Today! · Live Mortgage Rate Quote Tool – Live Rates 24/7. Get the lowest home mortgage rate to buy a home. Apply for a mortgage online to see why Lower is the best mortgage lender. + 5-Star Reviews. Mortgage brokers. If you want to compare a number of different mortgage lenders in one place, a mortgage broker may be a good option. They don't actually lend. Best for lower credit scores: Rocket Mortgage · Best for flexible down payment options: Chase Bank · Best for no lender fees: Ally Bank · Best for flexible loan.

Lotus Cost

See Lotus's full lineup of new and used vehicles. Read reviews, see photos, and compare models by price, specs, and features. Lotus Emira Lease Deals Near You · Lease your Emira for as low as $1, /mo. Term: 36 months. MSRP: $, Lease Calculator · Customize your lease. For Sale · Lotus Evora GT. Asking Price: $89, · Lotus Evora Asking Price: $71, · Lotus Evora. Asking Price: $39, · Lotus Emira. View photos & features of new & used Lotus vehicles for sale at Lotus Net Cost. Call for Price · Start Buying Process · Get Your Best Price · Contact Us. The Lotus Emira is a bombshell of a vehicle in every way for enthusiasts and will be a legend for years to come. Get started at Green Lotus. Start now – $ 30 days in-person classes up to 1x/day. Find out more. The Rolling 10 $/package. Welcome to Lotus Cars official website! Explore our models, find the nearest Lotus Centers and join the Lotus community. Used Lotus Evora Gray Lotus Evora 76 Photos. price drop. Lotus has announced the US pricing for the L AMG powered Lotus Emira First edition, and it comes in at an eye watering $99, See Lotus's full lineup of new and used vehicles. Read reviews, see photos, and compare models by price, specs, and features. Lotus Emira Lease Deals Near You · Lease your Emira for as low as $1, /mo. Term: 36 months. MSRP: $, Lease Calculator · Customize your lease. For Sale · Lotus Evora GT. Asking Price: $89, · Lotus Evora Asking Price: $71, · Lotus Evora. Asking Price: $39, · Lotus Emira. View photos & features of new & used Lotus vehicles for sale at Lotus Net Cost. Call for Price · Start Buying Process · Get Your Best Price · Contact Us. The Lotus Emira is a bombshell of a vehicle in every way for enthusiasts and will be a legend for years to come. Get started at Green Lotus. Start now – $ 30 days in-person classes up to 1x/day. Find out more. The Rolling 10 $/package. Welcome to Lotus Cars official website! Explore our models, find the nearest Lotus Centers and join the Lotus community. Used Lotus Evora Gray Lotus Evora 76 Photos. price drop. Lotus has announced the US pricing for the L AMG powered Lotus Emira First edition, and it comes in at an eye watering $99,

Used Lotus cars for sale near me. Best match, lowest price, highest price, lowest mileage, highest mileage, nearest location, best deal, newest year, oldest. Sticker price vs true Lotus dealer cost. Select a model to view dealer holdback, offers, rebates & incentives—See What The Dealer Paid | info-shaman.ru Makers of renowned light-weight track weapons, Lotus, has been making waves on the car scene with cutting-edge design and by the outi. The price of the M4A1-S | Black Lotus ranges between $ and $ across 18 online marketplaces. The current cheapest price of the M4A1-S | Black Lotus is. The Lotus Eletre R electric SUV costs $, Here are five gas-powered performance SUVs you can get for half that price. With great styling and superb performance, the Lotus Emira is a high-end sports car. Shame it's not quite as practical as alternatives. The price of Lotus cars in India starts from ₹ Cr for the Eletre while the most expensive Lotus car in India one is the Eletre with a price of ₹ Cr. costs, inflation and changes in (local) taxes. The final price of the vehicle depends on the chosen model, options, specifications and taxes. The images. Like the lotus flower, our Enchanted Lotus collection is a celebration of the Enchanted Lotus necklace in rose gold and mother-of-pearl. Original price. Galpin's internet advertising is intended only for persons in California. PRICE All advertised prices exclude government fees and taxes, any finance charges. Pricing for the initial Emira Launch Edition starts at $93,, with the plan to roll out lower-priced (but lesser-equipped) models in the near future. Given. Lotus Emira V6 First Edition. $, World Imports Fixed Price: $, Hide Pricing Lotus Emira V6 First Edition. $, Sale Price. We have all vehicles covered from the cheapest Lotus model (Lotus Europa priced from $9,) to the most expensive (Lotus Eletre priced up to $,). You can. Lotus Esprit. Price. $67, Lotus Lotus 23B. Price. $45, Lotus Elise. Price. $62, The price of Lotus cars in India starts from ₹ Cr for the Eletre while the most expensive Lotus car in India one is the Eletre with a price of ₹ Cr. Pricing and Which One to Buy. The price of the Lotus Emira starts at $77, and goes up to $, depending on the trim and options. The Emira will. $99, - $, Trade-in or sell your vehicle in just a few easy steps. Get My Offer. Lotus Emira Trims. LOTUS Trumpets. LOTUS Trumpets LCLASSIC Classic Professional Trumpet. Price: $5, LOTUS Trumpets LL L Cup Trumpet Mouthpiece. Price: $ Search from Used Lotus cars for sale, including a Lotus Elise, a Lotus Elise, and a Lotus Exige ranging in price from $ to $ Card Images, Info and Price History for Black Lotus from the mtg set Limited Edition Beta.

Tesla Charging Station At Home Price

Installing a Tesla fast home charger in your garage can cost between $1, and $7, The Tesla home charger costs $, and installation costs $ to $6, Although often higher in California, average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to. I purchased the Tesla Wall Connector from info-shaman.ru directly for $, and got it installed in December Installation costs will vary based. At most Tesla Supercharging stations in the US, the rate is $ per kWh, or about double the average home rate, so around $14 or at a Supercharger, using the. The average cost for home charging is 32p per kWh and 48p per kWh for a public charging station. When it comes to home charging, you can leverage comparison. The national average cost range for EV charging station installation is between $1, and $2, Most people pay around $1, for a volt outlet, Level 2. Charging at home allows you to take full advantage of low, overnight utility pricing by utilizing the 'Scheduled Departure' feature in your vehicle or charging. Fully charging a Tesla Model 3 Long Range with a 50 kWh battery at home will cost you around $ But remember, it can range from $6 to $39, depending on. Cost and Installation Level 2 charging stations range from $K per port, and installation costs are $k, inclusive of labor, materials and permitting. Installing a Tesla fast home charger in your garage can cost between $1, and $7, The Tesla home charger costs $, and installation costs $ to $6, Although often higher in California, average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to. I purchased the Tesla Wall Connector from info-shaman.ru directly for $, and got it installed in December Installation costs will vary based. At most Tesla Supercharging stations in the US, the rate is $ per kWh, or about double the average home rate, so around $14 or at a Supercharger, using the. The average cost for home charging is 32p per kWh and 48p per kWh for a public charging station. When it comes to home charging, you can leverage comparison. The national average cost range for EV charging station installation is between $1, and $2, Most people pay around $1, for a volt outlet, Level 2. Charging at home allows you to take full advantage of low, overnight utility pricing by utilizing the 'Scheduled Departure' feature in your vehicle or charging. Fully charging a Tesla Model 3 Long Range with a 50 kWh battery at home will cost you around $ But remember, it can range from $6 to $39, depending on. Cost and Installation Level 2 charging stations range from $K per port, and installation costs are $k, inclusive of labor, materials and permitting.

The average cost to fully charge a Tesla at home in is between $ and $ · The actual cost to charge your Tesla will vary depending on where you. Level 2 is found at many public and workplace charging stations, and also in many homes. It uses the same standard connector as Level 1 charging, meaning any. Lectron Home Level 2 NACS Tesla V-BOX Pro EV Charging Station | V | 48 Amp | NEMA / Hardwired ; Rating Snapshot. Select a row below to filter reviews. 5. cost through their electric utility. For more information check with your utility. About EV Charging at Home. A Level 2 charging station installation. How Much Does a Tesla Home Charging Station Cost? The Generation 3 Tesla Wall Connector with a Tesla proprietary plug costs $, while the Universal Wall. Property managers will soon be able to set the price of charging sessions With a Wi-Fi connection, Tesla will update your charging stations over. Charging a kWh Model X battery at home, assuming the U.S. average electricity rate of $/kWh and 85% charging efficiency, costs about $ For the. Price of Charging At Home Tesla's Wall Connector costs $ directly from Tesla. The company also offers a Universal Wall Connector for $ that can work for. No Upfront Cost. A new Tesla owner gets the /V adapter for plugging into a regular ol' home outlet at no additional charge. What Are the Costs? · Level 2 charging stations start around $ · Installations often run $$1, (plus the cost of electrical panel upgrades if required). Chargers · Wall Connector. $ · Universal Wall Connector. $ · Mobile Connector. $ · Powershare Home Backup Bundle. $2, Electric Car Charging Stations - Home ; Tesla Wall Connector (Generation 3) · $ Original price was: $ ; Tesla Universal Wall Connector · $ Many EV owners choose to install a Level 2 charger in their garage. The cost isn't cheap. About $2, for parts and installation is a reasonable ballpark. You can likely expect to spend an electric car charger installation cost of between $ and $ if the electric panel is in the garage and $ to over. Cost and Installation. DCFC charging stations are about $K in equipment cost, combined with $K in electrical service upgrades. The Charge Ready NY. Many EV owners choose to install a Level 2 charger in their garage. The cost isn't cheap. About $2, for parts and installation is a reasonable ballpark. Use our calculator below and one of our EV charging experts will follow up with pricing details! Customers can save up to 50% off their EV charger installation. However, if you have a kWh battery, it may cost up to $43 to charge your vehicle at a charging station. Is It Expensive To Charge a Tesla at Home? In the. For customers who drive less than 40 miles a day, at 11 cents per kilowatt-hour (the national average), it should cost less than $1 to $ a day to fuel an EV. Tesla Home Charging Station Cost. The Tesla Mobile Connector is currently priced at $ while the Wall Connector costs $ If you're opting for the Wall.

Buying A Business Advice

8 Steps to Buying a Business · Step 1: Find a Business to Buy · Step 2: Conduct Your Due Diligence · Step 3: Choose a Deal Structure · Step 4: Determine a Purchase. The first step in buying a business is working out which industry is perfect for your skill sets and know-how. Interested in buying a business? Here's what you need to know · Understand your motivation · Explore all your options · Carefully examine important documents. Due Diligence · Professional advice · Review and understand the documentation · Documenting the transaction · Conclusion · Resources to assist you. Due diligence can include reviewing the business' financial records with your advisers, which can help you analyze the financial state of the business and the. Whether you use a broker or go it alone, you will definitely want to put together an "acquisition team"--your banker, accountant and attorney--to help you. Advantages of Buying a Business. A It is prudent to get professional advice from your lawyer, your accountant and even a business valuation expert. 1. Get professional advice. Professional help is invaluable as you go through the negotiation, valuation and purchase process. Start conducting due diligence about the business. Learn all that you can about the background of this company. It is advised that you do not do this alone. 8 Steps to Buying a Business · Step 1: Find a Business to Buy · Step 2: Conduct Your Due Diligence · Step 3: Choose a Deal Structure · Step 4: Determine a Purchase. The first step in buying a business is working out which industry is perfect for your skill sets and know-how. Interested in buying a business? Here's what you need to know · Understand your motivation · Explore all your options · Carefully examine important documents. Due Diligence · Professional advice · Review and understand the documentation · Documenting the transaction · Conclusion · Resources to assist you. Due diligence can include reviewing the business' financial records with your advisers, which can help you analyze the financial state of the business and the. Whether you use a broker or go it alone, you will definitely want to put together an "acquisition team"--your banker, accountant and attorney--to help you. Advantages of Buying a Business. A It is prudent to get professional advice from your lawyer, your accountant and even a business valuation expert. 1. Get professional advice. Professional help is invaluable as you go through the negotiation, valuation and purchase process. Start conducting due diligence about the business. Learn all that you can about the background of this company. It is advised that you do not do this alone.

Start or buy a business. Make informed decisions as you pursue your dream. There's a lot to consider when starting a company or buying a business for sale. Or can the company grow with extra help? Those are important questions during an acquisition. Does the business have the potential for. In this guide, we take you through some key steps to buying a business and lead you toward success. The first step is to determine the value of the business so that you do not overpay for it. There are a variety of methods for evaluating businesses. Guide to Buying an Existing Business · 1. Identify the Industry · 2. Identify the Type of Business · 3. Evaluating Opportunities for Buying an Existing Business · 4. Find the right business – It might pay to use a professional advisor if you want to buy a business, as they'll find and deal with the target companies for you. Seek out an experienced business broker who can assist you in finding a business and coordinate the sequence of events. Utilize an accountant who can help you. Perform due diligence · Get an independent business valuation · Assess the company's assets · Look into any liabilities · Decide whether its best to go all in or. What to consider before buying a business · Conduct due diligence · Know what you're paying for · Evaluate the goodwill · Investigate a restraint of trade clause. 1. Determine What Type of Business You Want to Invest In · 2. Research Your Available Options · 3. Issue a Letter of Intent · 4. Do Your Due Diligence · 5. Secure. Consider engaging an attorney, CPA, or a broker to assist your due diligence process. A few thousand dollars of professional help may save you. 6. Buying a business · Get professional advice · Research · Initial viewing and valuation · Arrange finance · Make a formal offer · Negotiation · Completion. Deciding to buy is step one. Then, you need to start researching existing businesses to find one that is a good fit for your budget and your interests. Understand your motivation · Explore all your options · Carefully examine important documents · Assemble a team to help with the process · Leverage relationships to. I have one business that I started 13 years ago, then acquired one three years ago and another one this year. Just perform financial, legal and. Understand your motivation · Explore all your options · Carefully examine important documents · Assemble a team to help with the process · Leverage relationships to. Once you've narrowed down your choices, consider: · Ask your accountant or hire a CPA to help verify financial information · Verify the company's earnings (look. Download the free Guide to Buying a Small Business and get an overview of the business buying process, including how to find and value businesses and tips for. Small business development corp will help. Call your local bank about an sba loan. They will hook you up with sbdc. Researching businesses to buy · Hiring a business broker (optional) · Pre-qualification with lenders for financing · Making a purchase price offer · Letter of.

Can I Borrow Money Against My Life Insurance Policy

Yes. Once the cash value of your permanent life insurance policy reaches a certain level, you will be able to take out a loan against it. Many policy owners. How Soon Can I Borrow from My Life Insurance Policy? You can borrow as soon as you've built up a little cash value. With whole life policies, it may take. Life insurance policy loans allow you to borrow money from the insurance company using your policy's death benefit and cash value as collateral. Taking out a loan against your cash value is allowed by some life insurance policies. This means you're borrowing money from the insurance company, using your. Yes. The money can be used for any purpose including buying a home. The value of a life insurance policy belongs to the owner of the policy, and they are free. You can typically borrow up to the cash value on your life insurance policy. This life insurance loan may include the portion of your paid premiums that. Can I borrow money from my life insurance to buy a house? Yes, if your permanent or whole life insurance policy has accumulated enough cash value, you may be. No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. The cash value will always be less than your first years payment (anywhere between 0 and 90% of your first years premium could show up in cash. Yes. Once the cash value of your permanent life insurance policy reaches a certain level, you will be able to take out a loan against it. Many policy owners. How Soon Can I Borrow from My Life Insurance Policy? You can borrow as soon as you've built up a little cash value. With whole life policies, it may take. Life insurance policy loans allow you to borrow money from the insurance company using your policy's death benefit and cash value as collateral. Taking out a loan against your cash value is allowed by some life insurance policies. This means you're borrowing money from the insurance company, using your. Yes. The money can be used for any purpose including buying a home. The value of a life insurance policy belongs to the owner of the policy, and they are free. You can typically borrow up to the cash value on your life insurance policy. This life insurance loan may include the portion of your paid premiums that. Can I borrow money from my life insurance to buy a house? Yes, if your permanent or whole life insurance policy has accumulated enough cash value, you may be. No. The FEGLI Program provides group term life insurance. It does not have any cash value and you cannot borrow against your coverage. The cash value will always be less than your first years payment (anywhere between 0 and 90% of your first years premium could show up in cash.

Yes, you can get a loan taken out on your policy, but it does reduce the death benefit available to your loved ones should you pass before the loan is paid back. Borrowing against life insurance, also called a Living Benefit Loan, make it possible for you to receive up to 50% of your life insurance policy's death. Can you take out a loan against your life insurance policy in Canada? Yes, it is possible to take out a loan against your life insurance policy in Canada, but. Borrow against the policy You can often take out a loan with the cash value of your life insurance policy as collateral. With any loan, however, you'll be. You can borrow against your life insurance if the plan you choose has cash value. Cash value is a portion of your life insurance payment put into a savings-like. Flexible access to funds: With cash value life insurance, you can use the funds from the cash value component while you're still alive. Once you've built up. The loaned funds can be used however you'd like. Loans can serve as a source of supplemental retirement income, help with a loved one's college tuition, or help. You can borrow or withdraw money from your cash value whenever you like. There's no approval process, and any money you take out is usually income tax free You can borrow from your life insurance policy only if it has a cash value component. This feature is typically found in permanent life insurance policies. Open a home equity loan or line of credit. Homeowners can explore whether borrowing against their home equity is a better way to access cash. Borrow from your. Policyholders who have eligible permanent plans of insurance may borrow up to percent of the cash value of the policy after it has been in force for one. If you've had your life insurance policy for several years, the insurance company will often allow you to borrow from your policy's cash value. In most cases. You can borrow money from a permanent life insurance policy once the cash value has built up to the borrowing threshold. Can I take a loan against any life insurance policy? No, not all policies allow loans. Term life insurance policies, for example, don't build up sufficient cash. How Much Can I Borrow From My Whole Life Insurance Policy? You can usually borrow up to a certain percentage of the cash value in your whole life insurance. Your insurance company allows you to borrow up to 90% of your cash value amount. In this scenario, that means you can take a life insurance loan of $45, A whole life insurance policy line of credit may be the liquidity you need · Lines range from $70, to $5,, · No application fee, closing costs, or pre-. Life insurance loans are completely different from traditional debt. Most people also like to compare a life insurance loan to borrowing from yourself with a. If you currently have a life insurance policy with cash value and want to borrow from it, it's easy to do. Simply reach out to your insurance provider and ask. Sometimes borrowing from your life insurance policy can make financial sense in a financial emergency or to pay off debt. The loan can even be tax-free.

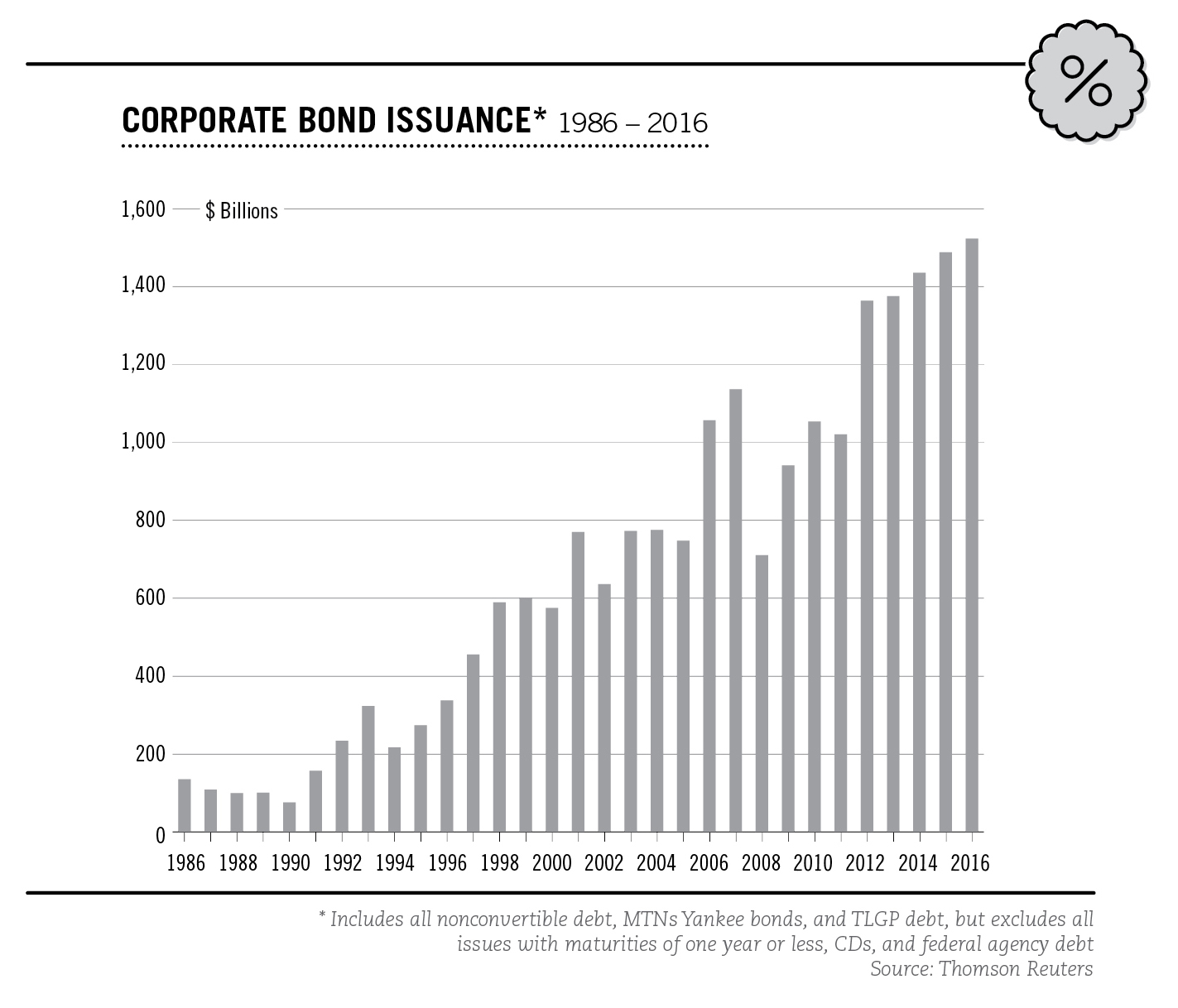

How Much Are Corporate Bonds

The S&P Canada Investment Grade Corporate Bond Index comprises a universe of Canadian dollar-denominated investment-grade debentures issued both domestically. Spread. Over Rf. Source Note. Aaa. %. %. %. Mergent Bond Record, January Aa. %. %. %. Mergent Bond Record, January Bond prices are quoted as a percentage of the face value of the bond, based on $ For example, if a bond sells at 95, it means the bond may be purchased for. The S&P ® Investment Grade Corporate Bond Index, a subindex of the S&P Bond Index, seeks to measure the performance of U.S. corporate debt issued by. With corporate bonds, one bond represents $1, par value, so a 5% fixed-rate coupon will pay $50 per bond annually ($1, × 5%). The payment cycle is not. EIOPA data contain CIC (corporate bonds, corporate bonds) with the reported credit quality step. of bond prices of similar bonds, and 𝜉 = is a. Moody's Seasoned Aaa Corporate Bond Yield is at %, compared to % the previous market day and % last year. This is lower than the long term. When you buy a corporate bond, you do not own equity in the company. You will receive only the interest and principal on the bond, no matter how profitable the. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. The S&P Canada Investment Grade Corporate Bond Index comprises a universe of Canadian dollar-denominated investment-grade debentures issued both domestically. Spread. Over Rf. Source Note. Aaa. %. %. %. Mergent Bond Record, January Aa. %. %. %. Mergent Bond Record, January Bond prices are quoted as a percentage of the face value of the bond, based on $ For example, if a bond sells at 95, it means the bond may be purchased for. The S&P ® Investment Grade Corporate Bond Index, a subindex of the S&P Bond Index, seeks to measure the performance of U.S. corporate debt issued by. With corporate bonds, one bond represents $1, par value, so a 5% fixed-rate coupon will pay $50 per bond annually ($1, × 5%). The payment cycle is not. EIOPA data contain CIC (corporate bonds, corporate bonds) with the reported credit quality step. of bond prices of similar bonds, and 𝜉 = is a. Moody's Seasoned Aaa Corporate Bond Yield is at %, compared to % the previous market day and % last year. This is lower than the long term. When you buy a corporate bond, you do not own equity in the company. You will receive only the interest and principal on the bond, no matter how profitable the. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7.

The S&P U.S. High Yield Corporate Bond Index is designed to track the performance of U.S. dollar-denominated, high-yield corporate bonds issued by companies. Tracking Bond Benchmarks ; U.S. Corporate · , , , ; Intermediate · , , , ; Long-term · , , , Bond funds, on the other hand, are a collection of many loans from different investors. The main difference is that individual bonds are specific loans, while. For example, you may not get your money back if the company issuing the bonds goes out of business. How is a corporate bond different to a debenture? A. View the current rates for provincial bonds, corporate bonds, U.S. dollar pay bonds and more. Bond prices are quoted as a percentage of the face value of the bond, based on $ For example, if a bond sells at 95, it means the bond may be purchased for. A corporate bond is a debt instrument, much like a loan, where the buyer of the bond (the 'bondholder') lends money to a company (the 'bond issuer'). It is the constant spread that, when added to the yield at each point on a spot rate curve (usually the U.S. Treasury spot rate curve) where a bond's cash flow. The yield curve for government bonds is an important indicator in financial markets. It helps to determine how actual and expected changes in the policy. Corporate bonds are issued by corporations and usually mature within 1 to 30 years. The bonds usually offer a higher yield than government bonds but carry more. Closing index values, return on investment and yields paid to investors compared with week highs and lows for different types of bonds. When companies want to expand operations or fund new business ventures, they often turn to the corporate bond market to borrow money. A company determines how. The corporate sector is evolving rapidly, particularly in Europe and many developing countries. Corporate bonds fall into two broad categories: investment grade. Total Result: 98 Bond Found. · % NAVI FINSERV LI Segment: Corporate | Type: NBFC · % MIDLAND MICROFI Segment: Corporate | Type: NBFC · %. Corporate bond valuation is the process of determining a corporate bond's fair value based on the present value of the bond's coupon payments and the repayment. Longer maturity bonds may offer higher rates, but their market prices tend to be more sensitive to changes in interest rates. Investment grade corporate bonds. This consists of $tn SSA bonds (68%) and $tn corporate bonds (32%). Global Bond Markets, Global SSA Bond Markets. The SSA bond markets. Bond ratings are based on various financial parameters of the company that issues the bond. The rated bonds fall into two categories: investment grade or. Corporate bonds are fixed-income investments where investors typically receive set payments twice a year. Contact your financial advisor to learn more. The HQM yield curve uses data from a set of high quality corporate bonds rated AAA, AA, or A that accurately represent the high quality corporate bond market.